FOR OFFICE

Get the right tenants in your office spaces faster with VTS

Decrease downtime by managing all of your team members and leasing activities in one place

OVERVIEW

Intuitive software built for office landlords

Forward-looking data to inform strategy

Digital marketing to attract new tenants

Collaborative software to move from leads to leases faster

One centralized platform that does it all

Office landlords need a digital solution now more than ever

Bring your leasing, asset management and marketing online with VTS. You'll increase the value of your portfolio by more proactively filling leases, achieving the best deal terms and building sustainable relationships with tenants, all while unlocking the insights you need to inform portfolio strategy.

SOLUTIONS

Get the right tenants in your office spaces faster with VTS

Optimize your strategy with unique insights

Forward-looking data to give you an edge

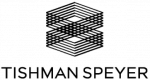

- Reinvent your investment strategy using real-time verified data instead of anecdotes

- Stay on top of important risks and opportunities in your portfolio with proactive alerts and clear visualizations of rent trends

- Leverage proactive alerts and clear asset visualizations to stay ahead of upcoming expirations”

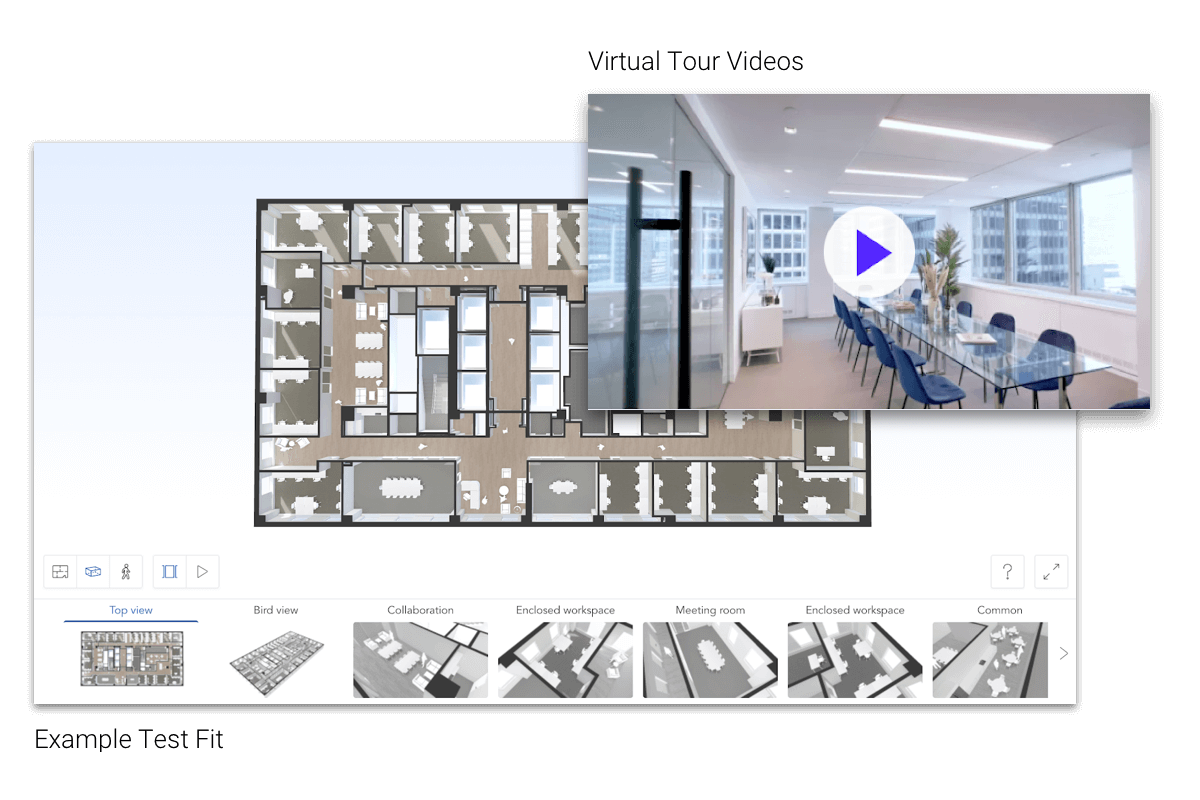

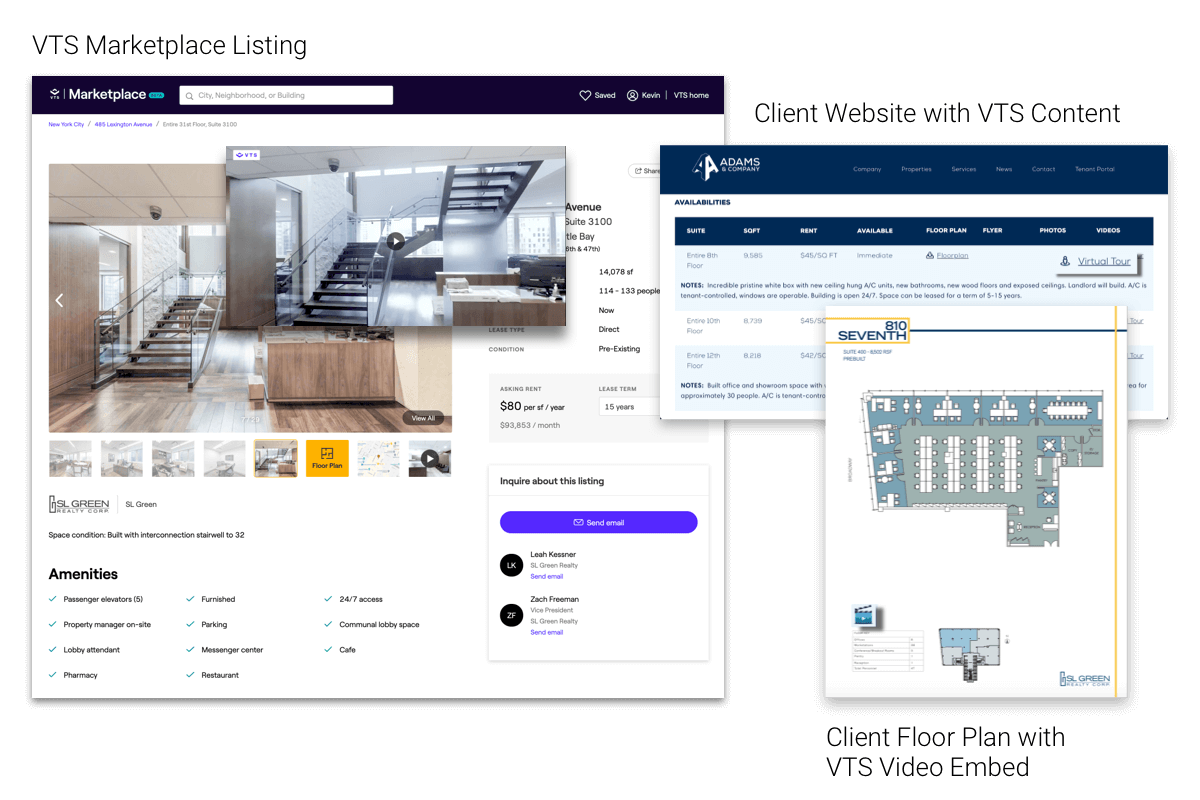

Drive virtual tours of your spaces to attract new tenants

The most effective marketing content in the industry - provided by VTS

- Beautiful and accurate virtual tours and photos of spaces, buildings and amenities filmed by VTS

- Virtual tours mean more than just video – VTS supplies test fits and 3D walkthroughs to showcase your space, no matter the condition

Get your spaces in front of tenant reps on all channels

Give tenant reps and tenants a fully-digital way to experience your spaces and assets

- Our digital content integrates with the channels you use today, including your corporate website

- VTS helps you scale into new multi-channel marketing across email, text, direct mail, retargeting and more

- Showcase your listings on VTS Marketplace, the only digital listings site built for tenant reps, by tenant reps

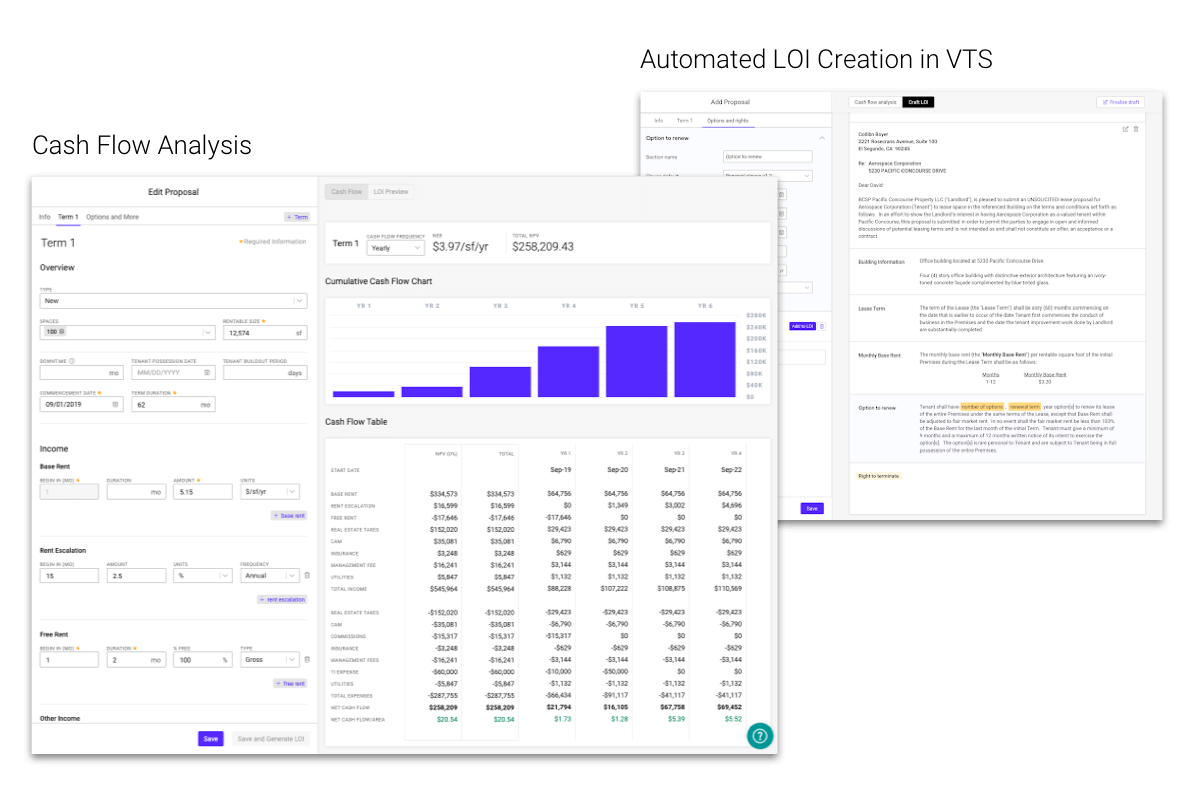

Reduce friction to get the deal closed

Generate LOIs and proposals automatically from within VTS

- Automatically calculate complex deal financials in VTS & see a real time cash flow analysis

- See back and forth proposals entered by brokers to keep track of negotiations

- Generate a letter of intent in your template with one click based on final deal terms

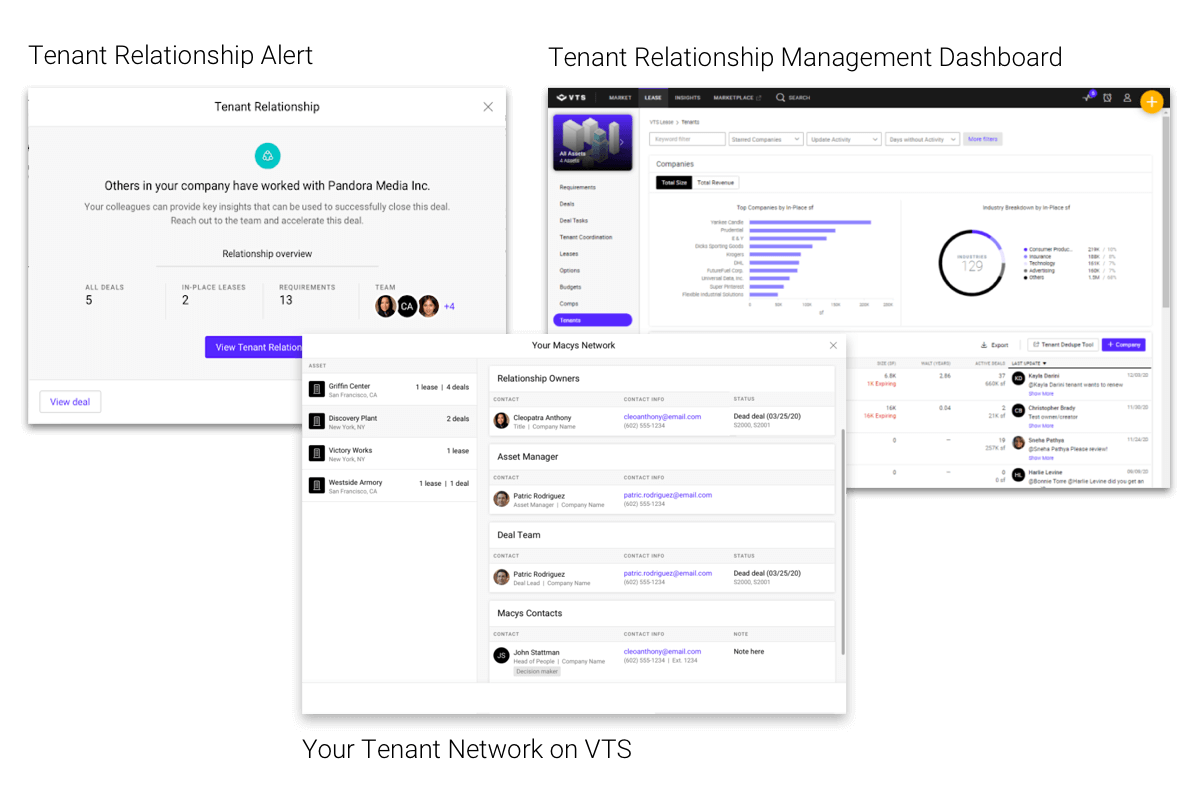

Keep your tenants in place to protect income

Unlock insights into your complex network of tenants to close deals and retain high value customers

- Strengthen relationships and retain tenants with central visibility into tenant updates from your teams and partners

- See exposure to risky tenants across your portfolio

- Close out renewals using historical lease and tenancy information at your fingertips

OFFICE ADVISORY BOARD

Meet our office advisory board

WHAT CUSTOMERS ARE SAYING

Hear from customers like you

“Since utilizing VTS, our net effective rents, on average have gone up more than 10%.”

Jim Whalen, CIO

Boston Properties

RESOURCES

Get and stay informed

MORE RESOURCES

Blog

Discover the latest trends impacting the CRE industry. Learn what you need to know to stay ahead of the competition.

Case Studies

VTS is transforming the way commercial landlords and brokers drive portfolio performance. Trusted by over 45,000 CRE industry leaders, learn how VTS can help you.

Webinars

Watch the biggest names in the CRE tackle the most pressing issues in the industry today.